Financial institutions across the world are in a race towards digitization and application innovation. Consumers demand online convenience, and cloud-based environments allow financial institutions to meet and surpass that demand. The disruptive growth of technology in finance is most pronounced within risk management. Big data and the enrichment of behavior insights through Machine Learning (ML) has completely redefined how institutions approach risk profiling. Financial services is a highly regulated industry, and new developments in IT and ML data modeling offer flexible, accurate, and agile solutions to mitigate monetary risk and ensure compliance.

AI/ML (The programming language of AI) streamlines and improves the old rules-based (and often faulty) algorithms built by humans. For fintech firms, this means comprehensive personas (that are far more accurate for risk profiling) can be developed based on customer actions. AI/ML is even predictive, capable of making future determinations based on past customer actions while processing extensive global rule sets. AI/ML is proving to be a gamechanger in cloud-based financial IT infrastructures.

- 80% of business executives report finding value from an AI deployment

- AI will deliver $13 Trillion in global economic activity by 2030, a 16% increase in GDP

- AI can facilitate a 20% immediate reduction in default rates

AI/ML facilitates new levels of personalization and actionable insight into customer data and presents the most innovative way for fintech companies to minimize risk.

Altering the risk management game

Banks and financial institutions using cloud-native environments leverage AI/ML to automate risk management from the vast amounts of customer data collected from multiple heterogenous sources. Machine Learning has impacted these scoring models and how they present monetary risk:

- Credit Risk Profiling – Machine Learning can make detailed risk assessments of a potential borrower with enriched insights. This information is far more reliable than the standard scoring of traditional credit bureaus.

- Market Risk Assessment – Bringing together disparate and automated data at scale means intelligent reporting on macro market stability can be devised, helping you make informed decisions for your financial service.

- Operational Risk Management – Integrating business workflows with Machine Learning can provide substantial efficiencies and cost savings. One bank utilized ML models to eliminate 35,000 investigative hours by locating and deleting 95% of its anti-money laundering (AML) false positives.

- Fraud Detection –AI/ML algorithms can prevent future fraudulent transactions based on historical attack patterns. The more samples of fraudulent activity your AI engine can draw from, the better it can scale and protect against illegitimate requests.

- Cyber Security –Artificial Intelligence can analyze millions of login attempts and potential credential stuffing, as well as secure individual cloud components to minimize data loss and threat exposure in a breach, thereby protecting sensitive customer data.

- Underwriting Risk Management – AI/ML uses Optical Character Recognition, language processing, and text extraction to sift through masses of data for underwriters. Previous approvals and rejections collated by ML engines can help insurers quantify their organization’s overall risk appetite. Forecasting models then assist in determining if a client risk profile fits within the close-ratio threshold.

- Compliance – Financial institutions must adhere to several industry regulations, which may require significant resources and additional cost. AI can help parse long and complicated compliance documentation. For example, AI algorithms can calculate Basel II and Basel III capital ratios between millions of outgoing and incoming daily transactions. This ensures lending is within pre-defined government limits and guarantees lower risk and continued compliance.

Benefits of AI/ML powered risk profiling

Risk profiling powered by AI/ML can transform financial services, helping fintech firms minimize risk. In turn, this provides several key benefits.

- Operational Improvements – AI-powered data categorization can clean extensive data strings at a rate faster than humans can. It is cost-effective to deploy, and as it can handle large components of micro-segments, your ability to scale is drastically increased.

- Loss Prevention – AI/ML-powered data engines have no subconscious bias and can glean numerous risk factors from millions of user transactions, a useful tool in loan servicing. Detailed personas and customer insights will decrease your total potential losses or defaults. AI decreases total loss expenditure for services by 23%.1

- Increased Data Accuracy – AI reduces the potential for data errors, reduces false positives, and improves your risk evaluations.

- Customer Trust – Offering cybersecurity, advanced digital applications, and convenient services builds customer engagement and overall trust in fintech services.

Harnessing the power of AWS and AI/ML

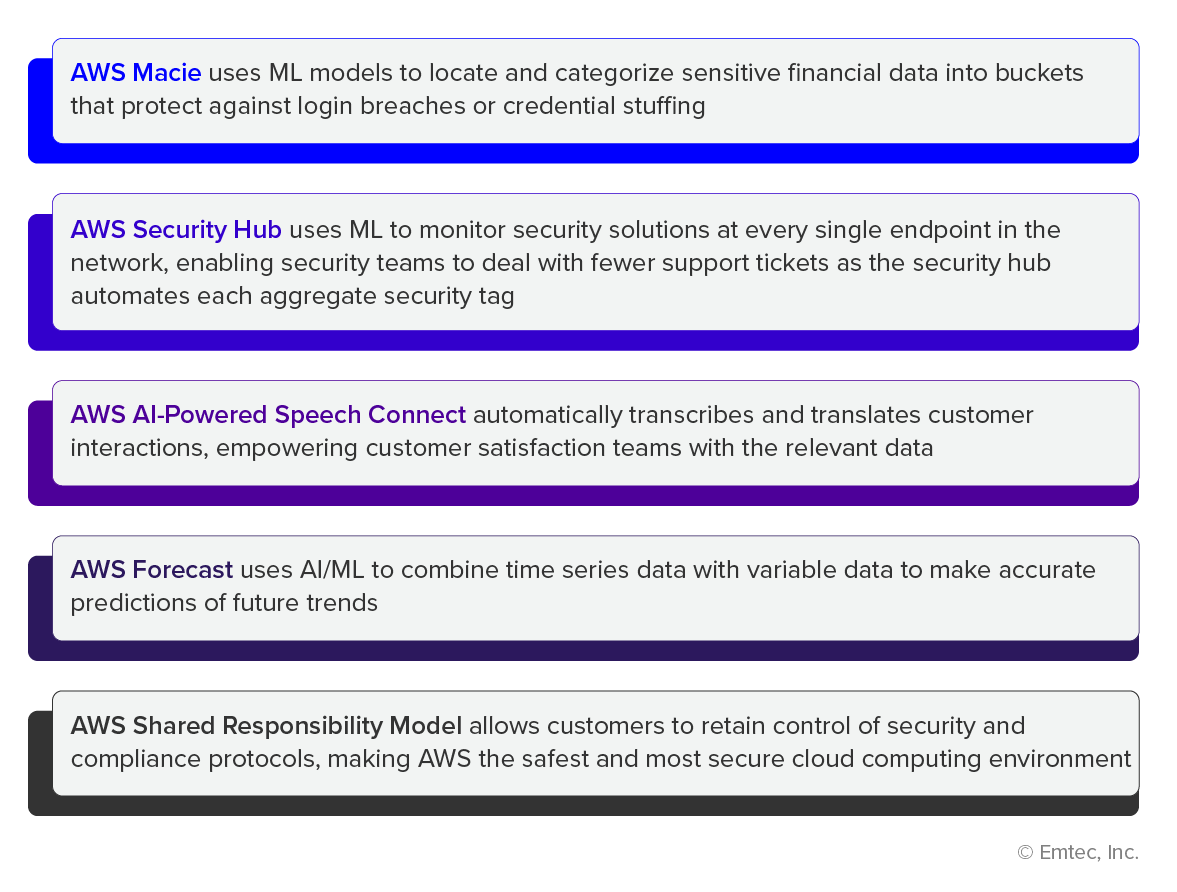

AWS provides a suite of application tools that leverage AI/ML to extract valuable customer insights in real time. The many AI-powered digital solutions offered by AWS allow fintech firms to instantly integrate several AI-based programs that facilitate risk management, helping achieve increased transparency and efficiency.

Here are just a few examples of fintech firms who have built on AWS:

- The Financial Industry Regulatory Authority (FINRA) built its platform on AWS and achieved 30% cost savings2

- DBS Bank forecasted a 90% reduction in grid infrastructure costs after migrating to an AWS installation of Murex’s risk management platform3

The AWS Financial Services Competency Partners Network

Migration to cloud-based environments is not an easy undertaking, which is why AWS has a dedicated partner network for support. A trusted AWS technology partner like Bridgenext (former Emtec Digital) can do the heavy lifting for you; helping implement the AWS AI/ML-powered applications you need to better serve your customers. Take advantage of the various cloud-based partner offerings that help identify, model, and assess risk without the hassle of technical build-outs. With the help of AI/ML-powered AWS services such as predictive analytics, intelligent document analysis, character recognition, and language processing, Bridgenext helps fintech companies manage and mitigate risk.

Bridgenext serves as a trusted partner to fintech firms like Varo Bank. With our help, Varo Bank now extracts and filters customer data utilizing advanced AI/ML algorithms for deeper customer insights. Contact us to learn how you can take advantage of AWS AI/ML services.

References

1towardsdatascience.com/the-growing-impact-of-ai-in-financial-services-six-examples-da386c0301b2

2www.finextra.com/newsarticle/34107/the-old-rules-no-longer-apply-risk-management-and-regulatory-reporting-in-the-cloud

3www.finextra.com/newsarticle/34107/the-old-rules-no-longer-apply-risk-management-and-regulatory-reporting-in-the-cloud