03.13.25 By John Carmody

In today’s dynamic financial landscape, competition between Wealth Management firms will continue to be intense. By 2025, the Great Wealth Transfer will be in full swing; trillions of dollars will shift from baby boomers to Millennials and Gen Z—clients with distinctly different expectations when it comes to financial advisors. This next generation is digital native. They seek tech-savvy advisors who offer personalized, collaborative, and seamless experiences powered by innovative technology.

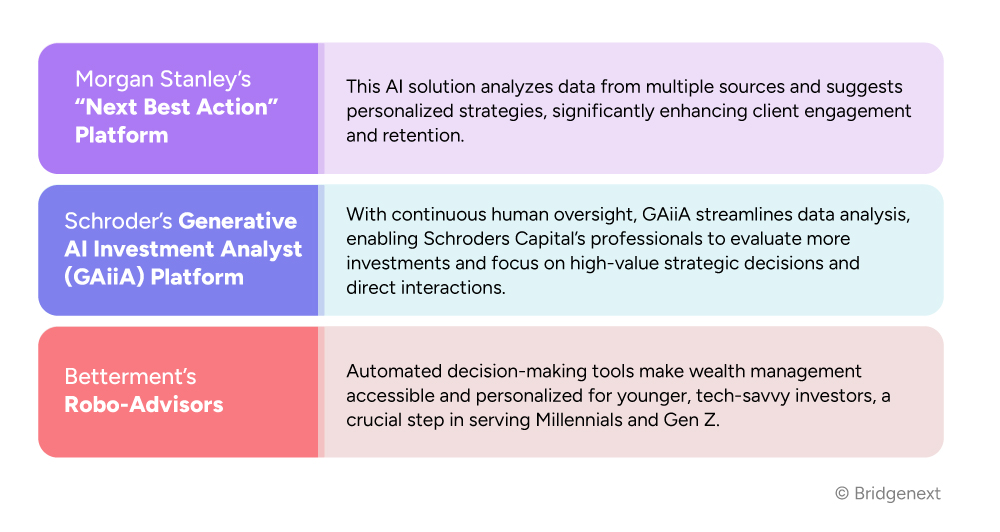

For wealth management firms and financial advisors that expect to compete, the AI-driven platforms are game-changing. Clients demand seamless, transparent, and efficient communication, while advisors seek ways to better meet their client needs, engage in relevant dialogue and enhance client relationships. This necessitates a shift towards secure AI-powered solutions for wealth management advisors that better enable collaboration and empower both advisors and their clients. Advanced AI helps wealth management firms meet evolving client expectations, enhance advisor productivity, and ensure long-term success in this exciting yet new market paradigm.

The days of inaccessible data, physical documents, and disjointed communication are numbered. Clients demand a single place where they can access all their financial information and interact with their advisors. They want to log into their accounts at midnight and instantly access reports. An AI-driven, centralized solution serves as a one-stop digital platform where clients can securely access everything they need. This approach offers several key advantages:

Modern investors expect personalization at every touchpoint. Advisors can harness AI-powered solutions that serve as a repository for essential industry data, financial documents and resources, while delivering tailored insights and fostering client engagement.

An educated client is not just empowered—they are loyal to advisors who make them feel knowledgeable about their financial trajectory.

AI-driven automation is a key driver of efficiency in the industry environment. Advisors equipped with AI-powered platforms can automate and share key reports, such as:

These solutions not only address customer concerns proactively but also free up advisors to focus on strategic opportunities.

Proactive communication is essential for effective client management. Automated solutions provide alerts for important events, ensuring that clients are always informed and engaged. By automating repetitive tasks, AI-powered tools also liberate advisors to engage in meaningful conversations and strategic planning with their clients.

With these capabilities, advisors are not bogged down by time-consuming manual processes. Instead, they can spend more time offering high-value insights and nurturing relationships.

The adoption of a centralized, secure AI-driven wealth management solution offers numerous benefits for both advisors and clients:

AI-driven, secure platforms are transforming the client-advisor relationship, fostering collaboration, enhancing transparency, and driving efficiency. By embracing digital innovation, advisors can provide superior client experience and build stronger, more enduring relationships. The future of financial advisory lies in leveraging technology to empower both advisors and clients, creating a more collaborative and successful partnership.

At Bridgenext, we’re committed to transforming the client-advisor relationship with cutting-edge AI solutions. We help wealth management firms and advisors seamlessly adopt advanced technology that fosters collaboration, enhances communication, and creates unparalleled value for clients.

We specialize in:

The Great Wealth Transfer doesn’t have to be intimidating—it’s an opportunity for forward-thinking advisors and firms to shine. Reach out to Bridgenext today and schedule a consultation with one of our subject matter experts. Together, we’ll turn this challenge into your competitive advantage.

Contact us now to lead the next generation of wealth management confidently.

References:

www.morganstanley.com/press-releases/key-milestone-in-innovation-journey-with-openai

www.schroders.com/en/israel/professional/insights/ai-revolution-what-will-it-mean-for-private-market-investors-/

www.bankrate.com/investing/betterment-acquires-robo-advisor-business-from-ellevest/