12.03.20 By Bridgenext Think Tank

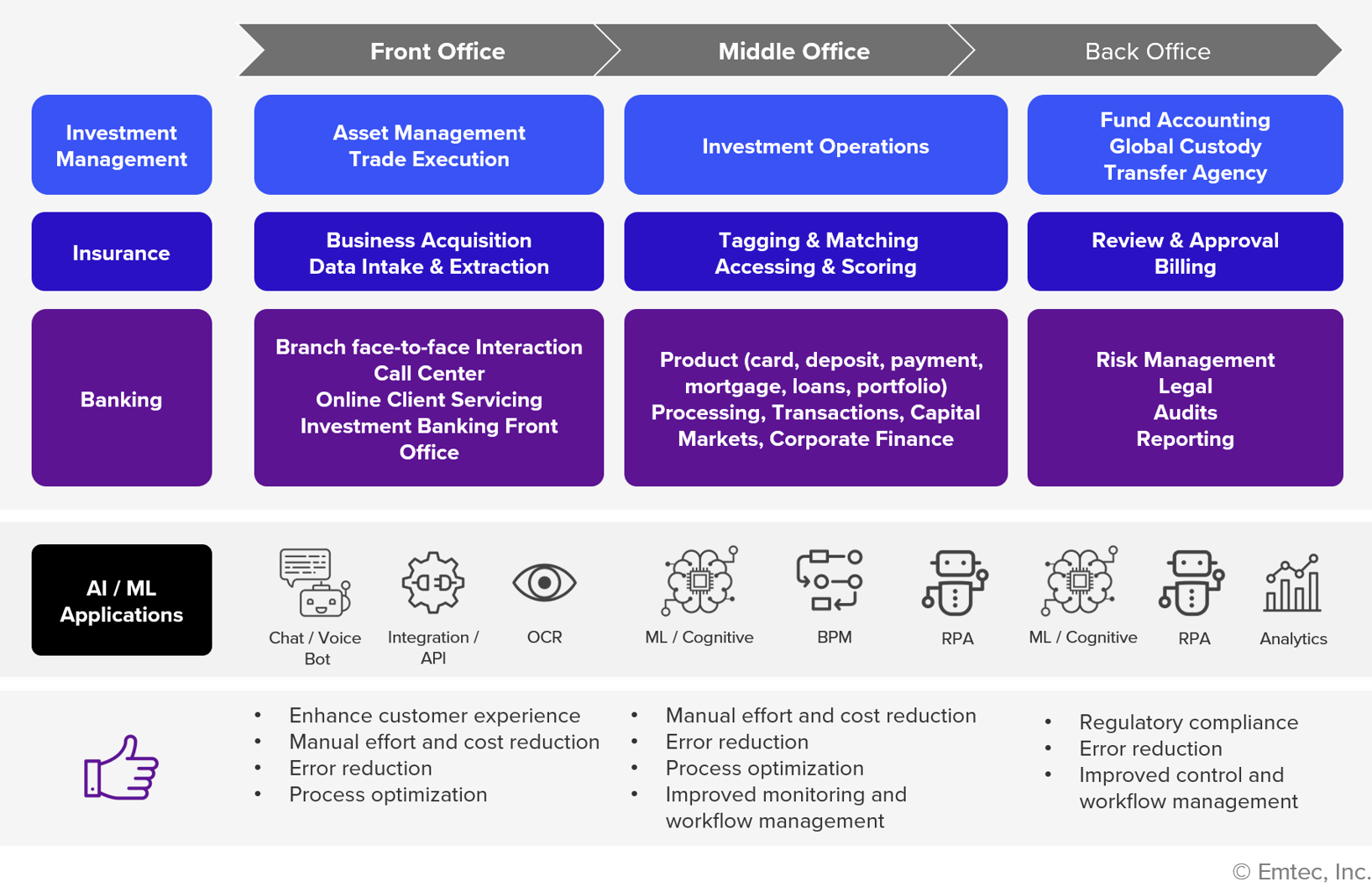

Advancements in data technologies and affordability of Machine Learning (ML) and Artificial Intelligence (AI) tools have reshaped the financial services industry like never before. Leading banks and financial services firms are deploying advanced technologies to streamline their processes, optimize portfolios, decrease risk and underwrite loans amongst other things.

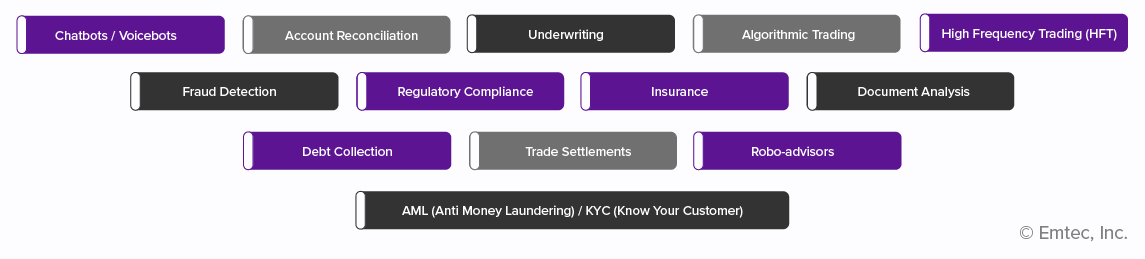

There are several financial applications where Machine Learning can provide exponential value. A few examples are listed below.

With robust Natural Language Processing (NLP) engines and the ability to learn from previous interactions, ML-based chatbots can quickly and accurately resolve customer queries without callbacks. These chatbots, available 24X7 with no wait time, can rapidly adapt to individual customer needs and changes in customer behavior.

Fraud prevention is becoming more complex with the mass adoption of e-commerce, increased cross-border payments, and the growing popularity of new digital payment methods. With Artificial Intelligence and Machine Learning, service engines such as Nets Fraud Ensemble can help reduce fraudulent transactions by up to 40%1. AI for fraud detection can also reduce the workload of security operations teams – like it did for DX Bank . McAfee estimates that cybercrime, of which financial fraud is a component, now costs the world around $600 Billion, equating to 0.8 percent of the global GDP . Examples include stolen identities, credit card fraud, fraudulent account takeovers, new account fraud, fraudulent insurance claims, or false positives. Hackers use AI and ML to methodically work their way into financial services networks. Fighting fire with fire, banks use AI and ML for fraud detection and prevention.

With terabytes of data and document capture technologies (i.e. invoices, paychecks, annual reports and cash flow statements), ML and NLP can do wonders for the applicant evaluation process by identifying anomalies and detecting patterns to determine if an applicant is eligible for a loan or insurance. These applications can provide a percentage of associated risk regarding repayment and potential for fraudulent claims.

Artificial Intelligence can assess customer risk profiles to generate a quote for the best insurance plan. This automation reduces front-end sales costs and improves customer satisfaction. Claims processing can also be optimized with AI. Accident images can be analyzed and repair costs estimated in real time. It can further detect fraudulent claims and check whether claims meet regulations. For example, insurance leader AXA recently rolled out three AI bots: Lenny, Bert, and Harry, as part of their customer and commercial property team. These bots take care of routine repetitive tasks, enabling their employees to focus on more analytical issues. The three bots are expected to save them over 18,000 man-hours per year .

An online automated investment management service uses computer algorithms to build portfolios and manage asset allocation based on risk appetite and investment objectives. Their clients benefit from a wealth of services provided at a lower cost! Some of the leading robo-advisors of 2019 include Wealthfront, Ellevest, allyinvest, Betterment, Personal Capital, Sofi Automated Investing, Bloom, and Nutmeg.

AI can contribute in efficient debt collection process. According to the CEO of Brighterion, a MasterCard company, effective use of AI can help reduce delinquency rates by around 76% .

Leveraging AI, bank account data can be extracted to compare with complex spreadsheets to accelerate account reconciliation and to eliminate errors.

AI with NLP can scan through legal and regulatory documents to detect irregularities without any manual intervention or error and with more speed.

Algorithms are used in hedge funds, (based on parameters such as timing, price, quantity etc.) to auto execute programs with a predetermined set of instructions for placing a trade. Algorithmic trading enables the execution of a large order by sending small increments of the order, called ‘child orders’ to the market at intervals. In 2018, over 50% of the 20 top-earning hedge fund traders and managers were associated with computer-driven algorithmic trading. Renaissance Technologies, one of the top hedge funds, has long been at the forefront of deploying machine and deep learning tools in trading. Other leading hedge funds including BlueCrest Capital Management, Bridgewater Associates, Citadel LLC, etc. also use ML and deep learning for trading.

High Frequency Trading (HFT) is basically algorithmic trading that occurs at high speeds beyond human capability – hundreds of thousands of trades per day executed by complex algorithms that analyze multiple markets to execute orders based on prevalent market conditions. Most pension funds, hedge funds, mutual funds and investment banks use HFT. A few of the biggest HFT players are companies such as Virtu Financial, Tokyo-based Nomura Securities, Citadel Securities, Two Sigma Securities, DRW and Tower Research Capital.

With deep learning and image recognition, scanned documents can be used for further analysis. At JP Morgan, a program called COIN (Contract Intelligence) uses ML to interpret documents. ML systems can scan and analyze legal as well as other documents with great speed, helping banks meet compliance mandates and combat fraud.

Trade settlement is the process of transferring securities into the account of a buyer and cash into the seller’s account following a stock trade. BNY Mellon has implemented robotic process automation software that allows them to perform research on failed trades, identify the problem, and fix any found issues.

Through image recognition and NLP, companies can enhance their KYC process for new client onboarding with improved speed. The ability to investigate through a vast array of external data sources leads to improved client onboarding experiences. ML can be trained to extract risk-relevant facts from huge volumes of data, making the process of identifying high-risk clients faster and easier.

Leaders in banking and insurance have already started AI implementations across their organizations.

Per IDC, global spending on AI systems in the banking sector was anticipated to exceed $5 Billion in 20193 for AI-enabled solutions including automated threat intelligence and prevention and fraud analysis and investigation. IHS Markit forecasts the actual business value of AI in banking worldwide to reach $300 Billion by 2030.

If the examples above are any indicator, AI and ML will continue to revolutionize the financial services sector. Those who invest will gain exponential dividends. Those that don’t will be left behind. Where are you on your journey?

Contact Bridgenext today to get started.

References