03.27.25 By Kathy Kelleher

The insurance industry faces a perfect storm of challenges. Claims cycle times are dragging, repair costs are soaring, and fraudulent claims are rising—eroding profitability at an alarming rate. On top of that, customers are becoming increasingly frustrated with slow, impersonal services, leading to declining retention rates. Traditional approaches simply aren’t cutting it anymore.

The numbers paint a stark reality:

AI-powered automation is no longer experimental—it’s becoming the backbone of modern insurance operations. However, with IT budgets growing by only 3.7% in 2025, insurers must strategically prioritize AI and automation initiatives to maximize efficiency and ROI.

This blog explores how AI and automation offer insurers a roadmap to drive profitability and reduce inefficiencies. But where should insurers start? One of the biggest opportunities lies in claims processing, a historically slow, manual, and resource-intensive function. By leveraging AI and automation, insurers can turn claims into a competitive advantage. Let’s see how:

Claims processing has long been a pain point for P&C insurers—bogged down by manual data handling, prolonged decision cycles, and errors that drive up costs and frustrate customers. Traditional models are proving unsustainable, with claims-related inefficiencies costing insurers billions annually. AI is now turning this challenge into an opportunity. According to Gartner, 49% of insurers have already deployed AI for claims processing. AI-powered automation, intelligent document processing (IDP), and predictive analytics are making claims handling faster, more accurate, and cost-efficient.

With zero-touch claims processing, AI can now handle everything from First Notice of Loss (FNOL) to settlement with minimal human intervention. Early adopters report that AI-powered claims automation has reduced processing times by up to 40%. The future of claims processing is no longer about incremental improvements. Insurers that embrace AI are seeing faster settlements, lower costs, and higher customer retention, proving that AI-powered automation is the new necessity.

Faster, more accurate claims processing is just one side of the equation. To truly optimize profitability and risk management, insurers must also rethink how they assess and price risk. That’s where AI-driven predictive analytics transforms underwriting, making it more precise, dynamic, and efficient.

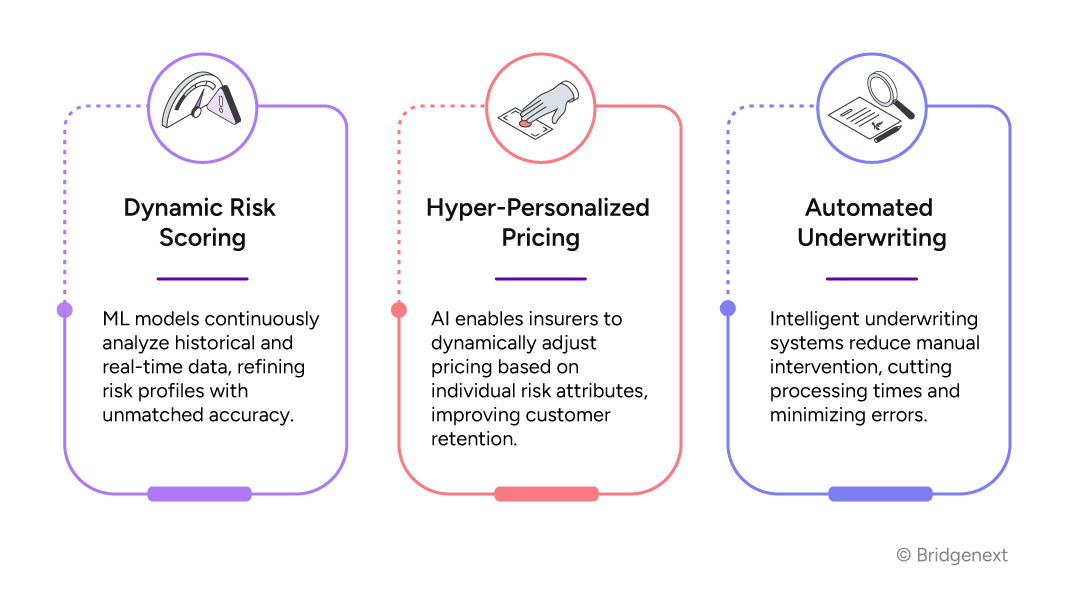

Underwriting is the bedrock of P&C insurance, but legacy methods—reliant on static models, manual processes, and outdated risk assessment techniques—are struggling to keep pace with today’s market demands. Rising claim severity, regulatory pressures, and evolving customer expectations require a shift from intuition-based underwriting to AI-driven precision.

According to Gartner, 50% of insurance enterprises have already deployed AI for underwriting. AI-driven models not only accelerate policy issuance but also improve pricing strategies and customer satisfaction.

Here’s how AI is reshaping underwriting:

With 70% of digital underwriting cases now receiving instant decisions and automated underwriting adoption growing rapidly, AI is proving to be a game-changer. Stronger underwriting means better risk selection, but the job isn’t done once a policy is issued. Fraudsters are getting smarter, and unchecked risks can erode profitability. To stay ahead, insurers need AI not only for underwriting, but also for detecting fraud, preventing losses, and managing risk with precision.

Insurance fraud isn’t just a growing problem—it’s an industry-wide crisis, costing insurers billions annually and driving up premiums for policyholders. Traditional fraud detection methods relying on manual review and rule-based systems are proving inadequate as fraudsters adopt more sophisticated tactics. The increasing frequency of fraudulent claims is forcing insurers to move beyond reactive detection and adopt AI-powered, proactive prevention strategies.

The numbers paint a stark reality:

– Gartner

AI isn’t just a shield against fraud—it’s also a powerful tool for building stronger customer relationships. While it protects insurers from losses, it also unlocks new ways to personalize interactions, anticipate customer needs, and deliver seamless experiences. Let’s dive into how AI is transforming marketing and customer engagement in insurance.

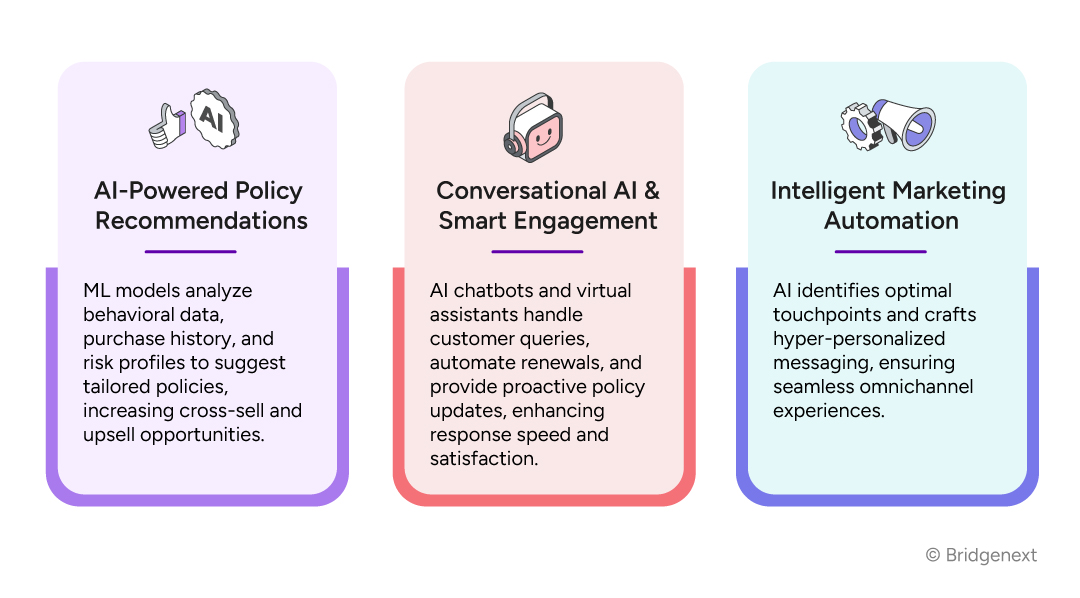

Insurance is no longer just about policies and premiums—it’s about relationships. Customers today expect insurers to understand their unique needs, communicate proactively, and offer seamless, hyper-personalized experiences across channels. Yet, many insurers struggle with fragmented customer data, generic messaging, and sluggish response times.

AI is changing that. According to Gartner, 93% of insurance CIOs prioritize customer experience as a critical outcome of their digital investments. Here’s how they are doing it:

Insurers that leverage AI for customer personalization are seeing significant improvements in retention, engagement, and revenue growth. According to Gartner, insurers that invest in AI-driven personalization see a 25% improvement in customer retention and cross-sell opportunities.

AI-powered personalization is changing how insurers connect with customers—but what if AI could do more than just predict needs? Generative AI is taking insurance to the next level, not just automating processes but reimagining them. Let’s dive into how Generative AI is reshaping P&C insurance.

Generative AI (GAI) is no longer a futuristic concept—it’s a transformational force reshaping the insurance landscape. GAI unlocks new possibilities, from automating claims to creating innovative insurance products tailored to emerging risks.

The 2024 Gartner CIO study revealed that GAI adoption in the industry stands at 6%, with an additional 33% expected to implement it by year-end.

With 89% of insurance CIOs increasing investments in GAI for 2025, it has become the fastest-growing technology in the industry.

Generative AI isn’t just another tech upgrade; here’s how it’s making a real impact in P&C insurance.

GAI automates document generation, such as subrogation packages, demand letters, and loss assessments, significantly reducing adjuster workloads and processing times. A leading European insurer reported a 14x increase in productivity across claims management using GAI, accelerating settlements and reducing costs.

Unlike conventional AI chatbots, GAI-powered virtual assistants can handle complex policy inquiries, claims disputes, and multilingual interactions with near-human efficiency. This leads to higher customer satisfaction, faster resolutions, and lower operational costs.

GAI enables insurers to analyze emerging risks in real time using behavioral analytics, telematics, and external data sources. This results in more precise underwriting, dynamic pricing adjustments, and faster policy issuance, reducing underwriting timelines by up to 70%.

With the power to process vast datasets and identify trends, GAI supports the creation of innovative insurance products—such as parametric insurance for climate-related risks or customized policies for gig workers.

As GAI adoption accelerates, its role in P&C insurance will expand, reshaping how insurers operate, interact with customers, and drive profitability. To turn AI potential into real business impact, insurers need a game plan. Here’s how to build a smart, strategic approach to AI implementation.

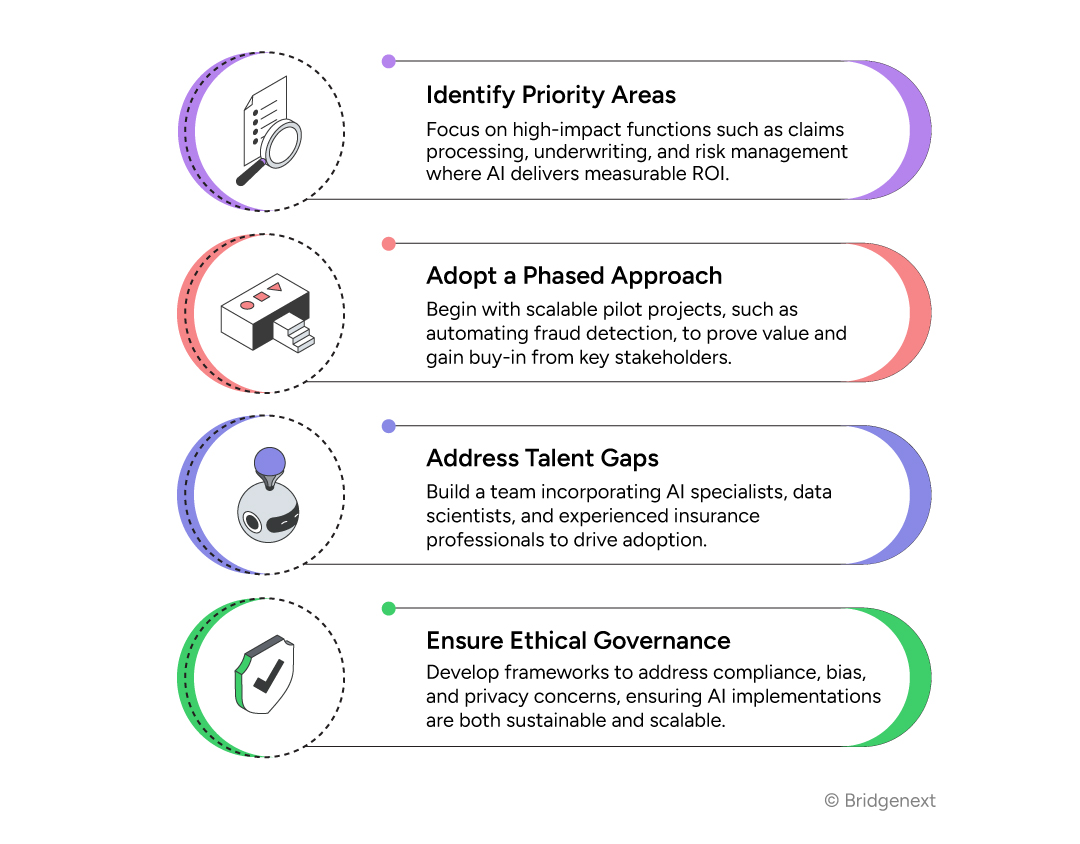

Successfully embedding AI in P&C insurance requires careful planning and prioritization. Here’s how to get started:

Having a strategy is great, but the real impact comes from putting AI to work. Insurers already using AI in claims, underwriting, and fraud detection are seeing faster processes, lower costs, and happier customers. Meanwhile, those still in the planning phase risk falling behind. The industry isn’t waiting—why should you?

AI and automation are no longer futuristic—they’re the present and future of P&C insurance. The industry is moving beyond traditional models, leveraging AI to accelerate claims, refine risk assessment, enhance fraud detection, and transform customer engagement. With generative AI adoption growing by 38% in just one year and 91% of insurers planning to implement AI-driven solutions by 2026, the question isn’t whether AI will reshape insurance—it’s how quickly you can capitalize on it.

Insurers that act now will gain operational agility, cost efficiency, and customer loyalty, while those who hesitate risk falling behind.

Take your first step toward the future. Explore how our expert solutions can help you harness the power of AI for sustainable growth — contact us today.

References:

www.forrester.com/report/the-future-of-insurance/RES131950?ref_search=0_1742455762343

www.forrester.com/report/predictions-2025-insurance/RES181572?ref_search=0_1742455762343

www.gartner.com/en/documents/5409263

www.gartner.com/en/documents/5641791

www.gartner.com/en/documents/5770715