08.04.22 By Bridgenext Think Tank

Dynamic pricing is not a new concept. If you use any ride-sharing service such as Uber or Lyft, you have already experienced dynamic pricing (surge pricing), which is based on the demand and supply of available drivers/taxis. Another classic example of dynamic pricing is in the airline industry – where seat prices fluctuate in proportion to available inventory.

The past few years in the transportation and logistics industry have been a roller coaster ride. Freight prices have spiked continuously, leaving both shippers and 3PLs over a barrel. Many companies have ridden out the market volatility by simply paying higher prices to get their loads covered. However, with the persistently tight capacity and ongoing instability, continuing to pay high prices isn’t sustainable in the long run. Furthermore, even when pandemic and geopolitical events-induced high prices have run their course, we can expect capacity constraints to remain, keeping freight prices inflated. How can companies gain resilience when freight prices are so volatile? With Dynamic Freight Pricing (DFP), companies can control freight costs and stay competitive.

In this two-part blog series, we talk in detail about Dynamic Freight Pricing and why it is such a crucial component in freight technology. The first blog is a primer on Dynamic Freight Pricing, its inherent benefits, and why shippers and 3PLs should strategize to implement DFP in their freight strategy. In the second blog, we deep dive into why DFP should be a key component of all shippers’ and 3PLs’ tech stack, the potential risks of not implementing DFP, as well as the core technologies supporting DFP integrations into Transportation Management Systems (TMS).

Dynamic Fight Pricing uses a combination of real-time market data and technologies such as AI, ML, and automation to serve up real-time capacity and freight pricing data. This allows shippers and 3PLs to get a concrete idea of what they should be paying carriers for loads and charging shippers for freight transportation. This is based on current market data and historical enterprise data – both internal and external. The supply chain tech revolution that began a few years ago has enabled more accurate pricing as the industry has become more digitized. The higher volume of accurate data that flows through integrated systems equates to more accurate dynamic pricing across global transportation markets.

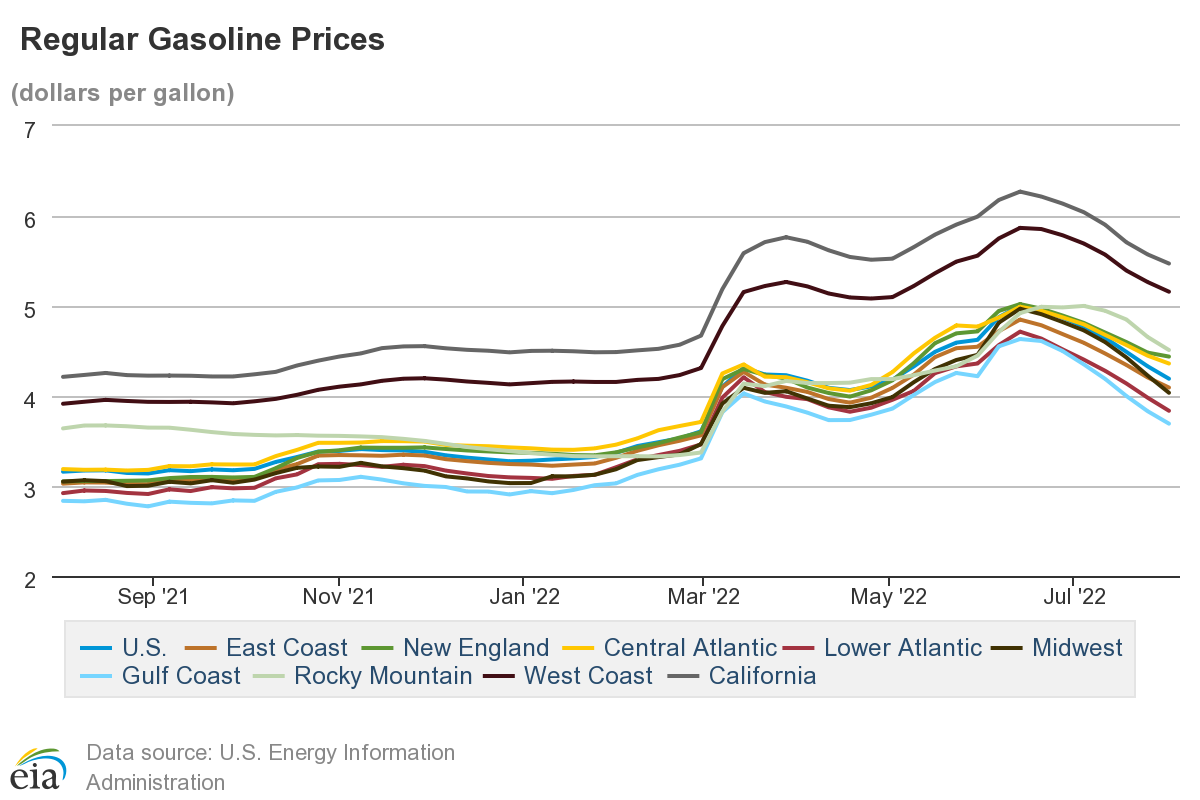

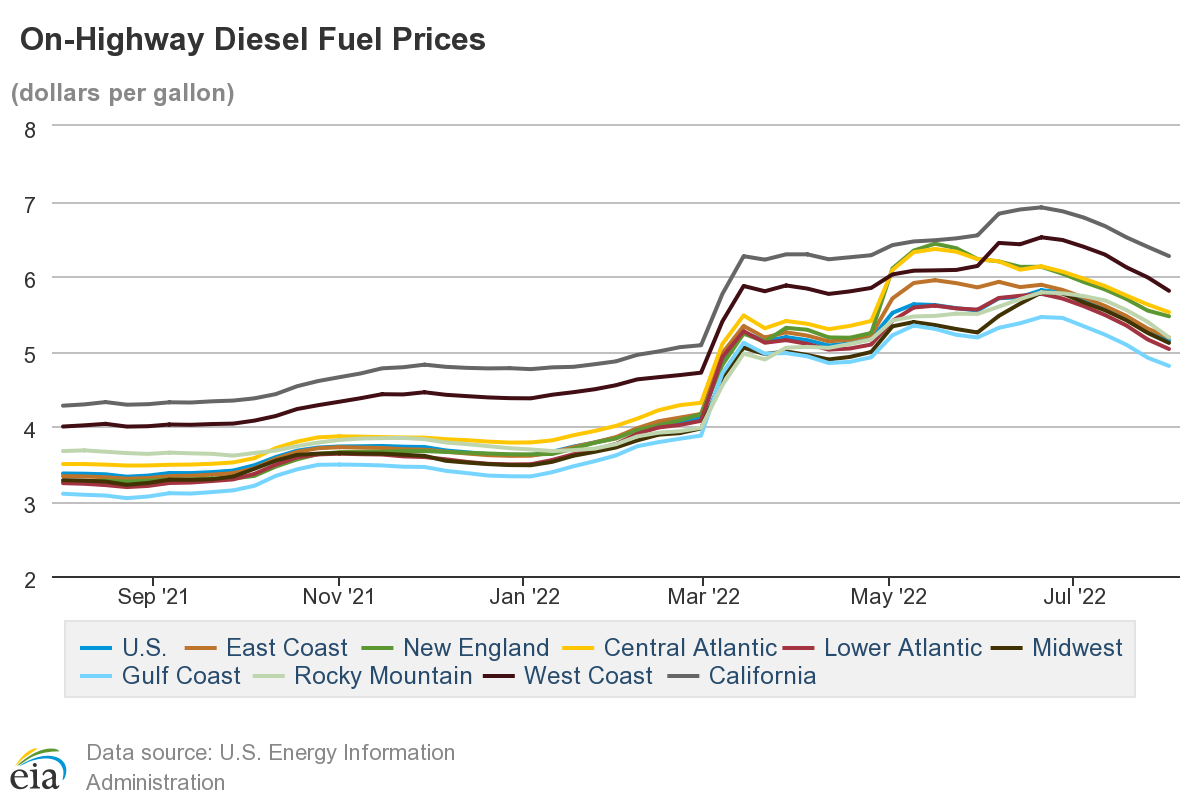

Several dynamic factors influence freight pricing, with fuel prices being the highest. Extreme volatility in fuel prices forces carriers to hike prices to maintain their margins. Interstate shipping is also expensive due to the drastic difference in fuel prices across different states. In the last few months, gasoline and diesel prices in the US have increased at an alarming pace, especially post the Russian invasion of Ukraine which has significantly impacted global oil markets. Implementing dynamic freight pricing allows 3PLs to factor in fuel prices and other external market conditions to effectively determine load pricing.

As the below U.S Energy Information Administration survey graphs1 indicate, on-road fuel and gasoline prices have fluctuated over the past year.

Between pandemic-induced shortages and capacity constraints, geopolitical unrest, and skyrocketing fuel prices, the last few years have shown the industry exactly how volatile freight prices can be. High costs are one of the biggest challenges companies face when the market is volatile. Dynamic Freight Pricing can help shippers and 3PLs negotiate a fair rate for their loads in the current market.

Trucking capacity is a seller’s market and is likely to remain so for the foreseeable future. It’s unlikely that the freight market will stabilize soon, and carriers know that shippers and 3PLs will pay more for loads if they must. Capacity was tight even before the pandemic due to the shortage of drivers and the rise of e-commerce. A broad capacity network can help companies negotiate lower shipping rates. Access to more capacity and determining the fair market price for a load helps logistics companies maintain their bottom line.

The logistics industry, in general, has been slow in technology adoption and dynamic pricing is an area that wasn’t fully explored till 2020. The impact of the COVID-19 pandemic on supply and demand for drivers and trucks led to carriers defaulting on contract rates, leading to a skyrocketing spot market. In this context, dynamic pricing has emerged as an effective solution to balance pricing across volatile markets.

Shippers and 3PLs tend to rely on complicated pricing methods as freight pricing varies by lane and carriers have their own methods for rating loads. With dynamic pricing, this process can be simplified and pricing can be brought in line with prevailing market rates. DFP enables price hikes during tight capacity scenarios and facilitates price drops when trucking capacity is high – resulting in a win-win situation for all – shippers, 3PLs, and carriers.

Dynamic pricing models can be connected via API or EDI into TMS, ERP, and other systems in the tech stack, including carrier portals for quoting and load booking.

There are several benefits of implementing dynamic freight pricing. While brokers are the most heavily targeted audience for dynamic freight pricing, both carriers, and shippers who handle their own logistics operations have much to gain from implementing dynamic pricing strategies. The below table highlights some of the potential benefits of dynamic pricing models for key freight stakeholders.

| Shippers | Brokers | Carriers | |

|---|---|---|---|

| Cost Savings | Shippers gain confidence to book their own loads rather than using freight brokerage services thanks to simplified market data research and capacity sourcing facilitated by dynamic pricing | Brokers can improve their margins when they have a more accurate picture of the market concerning a specific load, allowing them to find the perfect balance between competitive prices and higher revenues | Carriers can use dynamic pricing during quoting to ensure their quote is in line with current market prices |

| Superior Service Levels | When shippers pay the right amount for freight, they pass on fewer freight costs to their customers and deliver a higher level of service | The access to additional capacity can help brokers get loads covered faster and at better rates so they can serve their customers more effectively | Carriers can offer shippers and brokers more competitive rates when they’re confident with their pricing strategy |

| Enhanced Market Visibility | The market visibility enabled by dynamic pricing can help shippers manage loads better and pivot their freight strategy with ease and confidence | By understanding the market, brokers can identify profitable customers and lanes, determine which carriers they want to develop long-term relationships with, and recognize opportunities to expand their business | Carriers can use market data to determine which lanes will be the most profitable so they can align growth strategies accordingly |

Market volatility and rising fuel prices will continue to impact freight pricing. Shippers and 3PLs need a robust solution that can handle fluctuations and safeguard their profit margins. Dynamic Freight Pricing helps align load pricing with current market trends by factoring in fluctuating fuel costs and other external market factors. With transportation services becoming more commoditized, 3PLs will continue to evolve dynamic pricing models to retain a competitive edge.

Has your company considered implementing dynamic pricing integrations to balance the extreme volatility in freight pricing? We’d love to hear about your plans or experiences with dynamic pricing models.

Meanwhile, stay tuned for our second blog in this series on why you should integrate Dynamic Freight Pricing into your logistics tech stack.

References

1 https://www.eia.gov/petroleum/gasdiesel/