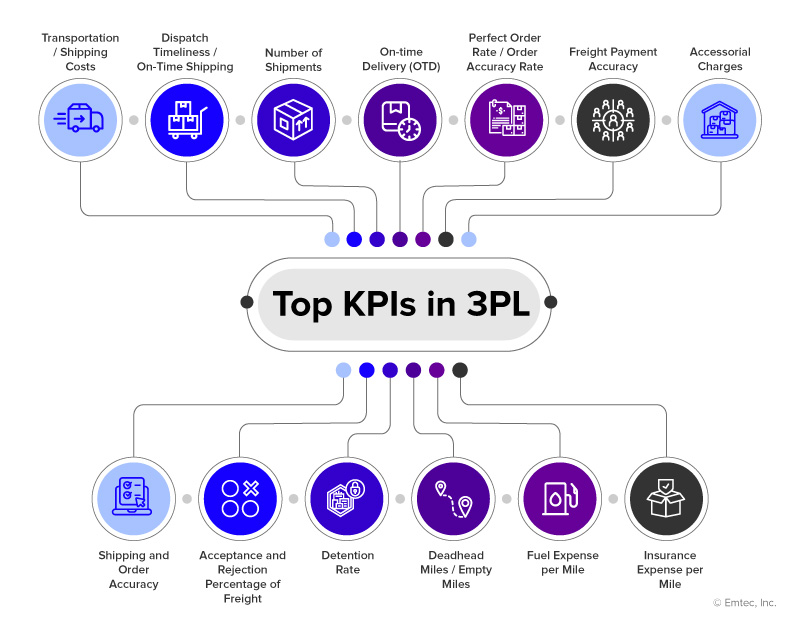

With the increase in competition and higher consumer demand, 3PLs have a greater focus today on optimizing their delivery processes to ensure optimal performance and achievement of key targets while remaining competitive. There are a handful of Key Performance Indicators (KPIs) that 3PL firms can use to make more informed real-time decisions. So, what are the top KPIs that should be monitored by 3PLs, and why is selecting the right metrics critical to operational success? In this blog, we give you an overview of the top metrics you should be diligently tracking and monitoring in real time. These metrics cover a wide range of focus areas including costs as well as shipping, delivery, and order related KPIs.

Let’s dive in.

Top KPIs for 3PL organizations

- Transportation / Shipping Costs: This is a key metric that includes all costs from order placement through to final order delivery. These costs typically include order processing costs, administrative overheads, inventory costs, warehousing expenses, and the actual cost of shipping levied by carriers. Monitoring these costs separately will allow you to identify where your costs are in excess (for instance, shipping costs might be low but administrative costs for order processing might be relatively high) and implement strategies to bring these costs down.

- Accessorial Charges: Unexpected, unplanned costs are a matter of concern for shippers and freight brokers as they eat into profit margins. Accessorial charges are a classic example. These costs refer to the fees for additional services provided by carriers to complete freight delivery. Accessorial charges are not included in the initial estimate and are usually invoiced after the shipment delivery is complete, creating additional expenses in logistics services. There are several reasons why accessorial charges may be incurred including:

- charges due to extra distance and time necessary to deliver shipments (in case of additional stops)

- special equipment handling charges to load / unload shipments

- special official permits required in case of loads exceeding legally allowed weights or dimensions, etc.

While there are many types of accessorial charges, the most important ones include detention fees, stop-off charges, lumper charges, layover charges, reconsignment charges, Truck Ordered Not Used (TONU) fees, and lift gate charges. A clear understanding of your supply chain will help you anticipate accessorial charges, allowing you to plan beforehand and keep freight costs under control.

- Dispatch Timeliness / On-Time Shipping: Ensuring timely shipping and delivery of goods to end customers is the cornerstone of the 3PL business. This important KPI will help you measure the performance of your supply chain by tracking the number of orders that have been shipped on or before the shipping date. Monitoring dispatch timeliness will enable you to spot any issues in the order fulfillment process, such as poor planning or fragmented execution systems incapable of meeting rising customer demand.

- Number of Shipments: Just like measuring the on-time shipping rate, you need to track the number of orders that are shipped out from the warehouse. This metric will help you monitor and analyze order trends and derive insights on peak demand (festivals, holidays, etc.) to plan resource allocation. To optimize KPIs related to order delivery, you can break down this KPI into multiple categories, for instance, number of shipments from different countries / regions and different types of products.

- On-time Delivery (OTD): This is a useful metric for all shippers, allowing them to identify supply chain bottlenecks causing delayed shipments and track how well they meet customer expectations. Low on-time delivery rates can lead to escalating late fees, not to mention angry, dissatisfied customers. A high on-time delivery rate represents the successful integration and alignment of all resources. Delays or temporary fluctuations within shipment rates can impact the overall percentage target, which is why it is necessary to capture as much data as possible to analyze larger trends.

- Perfect Order Rate / Order Accuracy Rate: This metric measures the accuracy of an order – from correct order entry to accurate order picking, impeccable shipping without causing damage, on-time order delivery, and accurate order invoicing. The order accuracy rate or perfect order rate should always align with your on-time delivery rate. Tracking this critical KPI will help you identify whether orders arrive on time and whether the freight is handled with care and attention to avoid damage to goods shipped. This could also help you monitor warehouse activities pertaining to order shipment and delivery.

- Freight Payment Accuracy: Freight payment accuracy measures the actual payment charges on shipments and how often shippers are charged the correct amounts. Instances of overcharging by carriers – by not honoring previously agreed discounts, erroneously charging for accessorial, or creating duplicate invoices – can be monitored by effectively tracking this KPI. Auditing your freight periodically is critical to measure this metric and resolve inherent issues, thereby keeping costs under check.

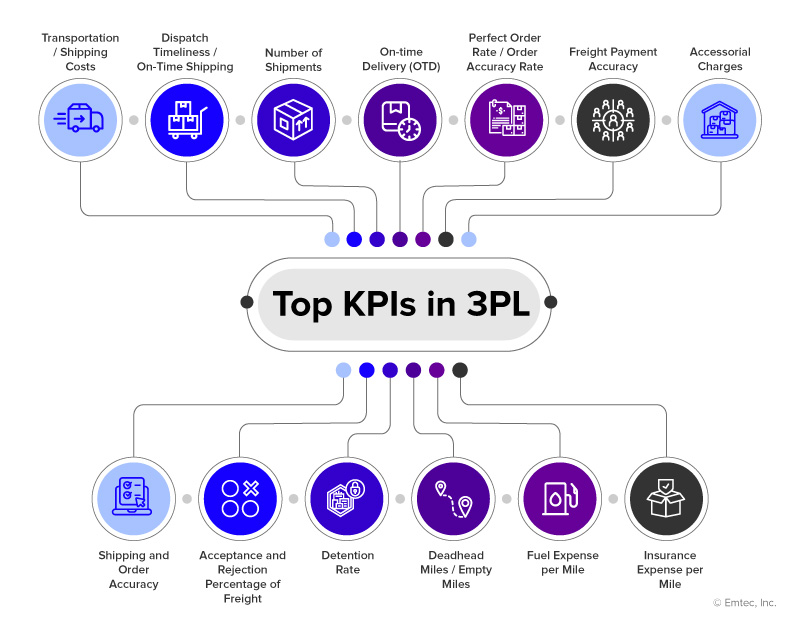

- Shipping and Order Accuracy: Accuracy is the backbone of the 3PL business. It is important to measure both shipping and order accuracy to ensure superior customer satisfaction. All orders must be shipped within a scheduled delivery timespan to the correct destination – this should be tracked across all categories, shipping lines, and routes to optimize processes. Likewise, ensuring that the customer receives the right order each time is a resource-intensive objective, which you need to optimize to improve process output. The shipping accuracy and order accuracy rate should remain close to 100% to build customer trust and avoid issues within the supply chain. The order accuracy KPI involves processes at the beginning of an order fulfillment cycle, while the shipping accuracy KPI is a metric that you should track after the order is shipped to end customers.

- Acceptance and Rejection Percentage of Freight: There are several reasons freight can be rejected, but the primary causes of concern for 3PLs include –

- limited number of carriers to accept loads (carriers with limited capacity sometimes reject loads)

- shorter lead times (shipments with very short lead times have the largest chances of being rejected in favor of shipments with multiple day lead times)

- unclear request for proposal (RFPs) (if carriers do not have all the necessary details about the loads they are supposed to pick, chances are they will reject it outright).

Rejected freight can cause monetary losses as rejected shipments need to be moved to the spot market, where the rates are considerably higher, and this could challenge the reputation of your 3PL business. It is crucial to track the rejection percentage of freight as well as the number of loads accepted by carriers, so that you can monitor and analyze recurring patterns, if any.

- Detention Rate: Detention is one of the biggest woes for trucking companies. Detention time denotes the time spent outside of the standard time to load / unload trucks (usually two hours). It is essential to determine the detention rate upfront, which is the fee charged by carriers for their detention time. For shippers, detention rates are unexpected costs that eat into their profits. To determine the detention rate, you first need to know your operating cost, which includes all expenses required to run your business. Once the total operating cost is determined, break it down into a per-hour cost. This will help you estimate the detention cost and negotiate an appropriate detention fee.

- Deadhead Miles / Empty Miles: Deadhead miles (also known as empty miles) are a common phenomenon in the trucking industry. These denote the distance in miles between two loads (after dropping off one load and before picking up the next load). Besides creating environmental hazards (increasing CO2 emissions), deadhead miles are not profitable and cause a big concern for trucking companies, especially when drivers need to pay for additional fuel. Sometimes, drivers are compensated for deadhead miles. To avoid financial losses, brokers might add a deadhead mileage incentive to shipping contracts. Load boards are an excellent tool to limit deadhead miles, where drivers can check for additional loads that fall within their specific route and pick up these jobs to reduce empty miles (this is called backhauling). Backhaul shipments come with lower rates than headhaul shipments, but while this could mean lower margins, it helps offset losses on account of empty miles.

- Fuel Expense per Mile: Fuel costs eat up a large part of profits for trucking companies (driver compensation being the first major profit inhibitor) and carriers often try to optimize fuel expenses when trying to improve margins. Fuel accounts for about 39%1 of the total operating cost in trucking. Negotiating the best price for purchasing fuel is a great starting point for reducing fuel expenses. It is important to calculate the Gross Fuel Expense per Mile. This includes total fuel purchase amount, fuel-related taxes, costs of fuel additives, and diesel exhaust fluid. A simple formula to calculate the Gross Fuel Expense per Mile is –

Gross Fuel Purchase Price + Taxes + Fuel Additives + Diesel Exhaust Fluid / Miles Reading at the End – Miles Reading at the Beginning

- Insurance Expense per Mile: Rising insurance costs are a big challenge in the trucking industry, especially for small carriers (large carriers are mostly self-insured). While insurance accounts for just 4%1 of total trucking expenses, multiple insurance policies for maximum coverage can increase premium costs substantially. Further, the latest US highway reauthorization bill raises trucking insurance liability to $2 Million2, mandating all trucks plying within the US to be fitted with an automatic emergency braking system for additional safety. Monitoring the insurance expense per mile rate is crucial if you wish to optimize the costs of your trucking or 3PL business.

Conclusion

Critical metrics have evolved over time for both asset-based and asset-lite 3PL providers. Prior, firms focused primarily on timely delivery rates, return rates, and shipping accuracy. With the acceleration of digitalization to improve analytics capabilities and track more in-depth metrics, these KPIs have radically transformed how 3PL providers optimize their operations, and manage incentives, growth, and profitability to achieve pre-determined targets.

What KPIs are you tracking to maximize operational and business efficiency? Contact us.

References

1https://www.thetruckersreport.com/infographics/cost-of-trucking/

2https://whattatruck.com/news/truck-insurance-increases-to-2-million-according-to-new-bill/